Benzix News Hub

Stay updated with the latest news, trends, and insights.

Marketplace Liquidity Models: Where Buyers and Sellers Dance

Discover dynamic marketplace liquidity models that make buying and selling a thrilling dance! Uncover secrets for maximizing profits.

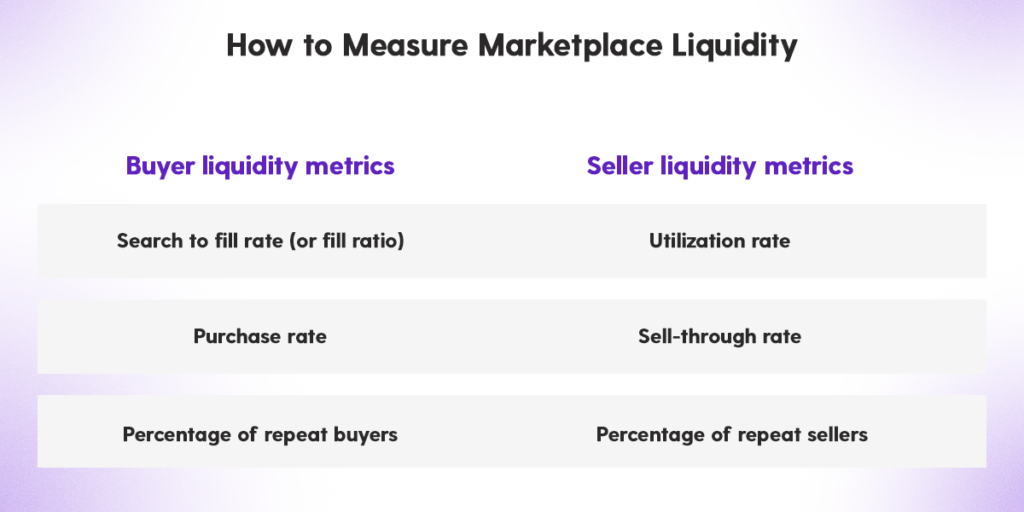

Understanding Marketplace Liquidity: Key Models and Their Impact on Buyers and Sellers

Marketplace liquidity is a critical factor that influences the dynamics between buyers and sellers. It refers to how easily assets can be bought or sold in the marketplace without causing significant price fluctuations. Understanding the different liquidity models is essential for participants in any marketplace, as they dictate the flow of transactions and the overall efficiency of trading. For instance, a market with high liquidity allows for quick buying and selling with minimal price changes, which benefits both buyers looking for competitive prices and sellers seeking timely sales.

There are several key models of marketplace liquidity, including the order book model and the market maker model. In the order book model, buyers and sellers place orders at varying prices, creating a transparent list that dictates the price at which transactions occur. On the other hand, the market maker model involves designated entities providing liquidity by continuously offering to buy and sell assets. Both models significantly impact market participants—buyers gain from the ability to transact swiftly, while sellers benefit from improved price stability and reduced slippage.

Counter-Strike is a popular tactical first-person shooter series that has captivated gamers since its inception. Players join either the terrorist or counter-terrorist team to complete objectives or eliminate the opposing team. For those looking to enhance their gaming experience, be sure to check out the daddyskins promo code for exclusive in-game items.

The Dance of Supply and Demand: How Liquidity Models Shape Market Dynamics

The interplay of supply and demand is a fundamental principle that governs market dynamics. At the core of this relationship lies the concept of liquidity models, which help investors and market participants understand how assets are traded and valued in various market conditions. Liquidity refers to the ease with which an asset can be bought or sold without causing significant price changes, and it directly affects the strength of the supply and demand relationship. In a highly liquid market, even large trades can occur with minimal impact on price, leading to more stable market conditions. Conversely, in a less liquid market, supply and demand imbalances can result in greater price volatility.

Understanding liquidity models enhances our grasp of how supply and demand fluctuations drive market behavior. For instance, during periods of economic uncertainty, demand for liquid assets, such as cash or government bonds, often surges, reflecting investors' preference for safety. On the other hand, when the economy is strong, demand shifts toward riskier assets, driving prices higher. This fluidity showcases the dance of supply and demand, where liquidity acts as a vital force shaping investor sentiment and market trends. By analyzing these trends, market participants can make informed decisions, ultimately navigating the ebbs and flows of market liquidity effectively.

What Makes a Marketplace Liquid? Exploring Factors that Drive Buyer and Seller Interaction

In the realm of online commerce, liquidity in a marketplace is fundamentally influenced by several critical factors. First and foremost, market depth plays a vital role, as it indicates the number of active buyers and sellers at any given time. A marketplace exhibiting high liquidity will typically have a large pool of participants, which enhances transaction frequency and allows for smoother exchanges. Additionally, transaction speed is essential; a marketplace that enables rapid trades fosters confidence among users, encouraging them to engage more readily. When buyers and sellers perceive that they can quickly execute their trades, the likelihood of returning to the platform increases significantly.

Beyond market depth and transaction speed, price stability is another essential factor that contributes to a marketplace's liquidity. When prices are volatile, users may be hesitant to engage, fearing potential losses or missed opportunities. By creating mechanisms that promote fair pricing and transparency, a marketplace can enhance buyer and seller interaction. Furthermore, the presence of liquidity providers, such as market makers, can also bolster liquidity by ensuring that there are always participants willing to buy or sell, thus minimizing gaps in the market. In summary, a combination of market depth, transaction speed, price stability, and liquidity providers are pivotal elements that drive effective buyer-seller interactions in any vibrant marketplace.